Listing Disputes

View a list of all disputed card payments.

A card issuer or bank disputes a card payment initiated by the consumer, and funds are automatically deducted from your client account. You can accept the dispute, or challenge the dispute as described in Viewing Dispute Details.

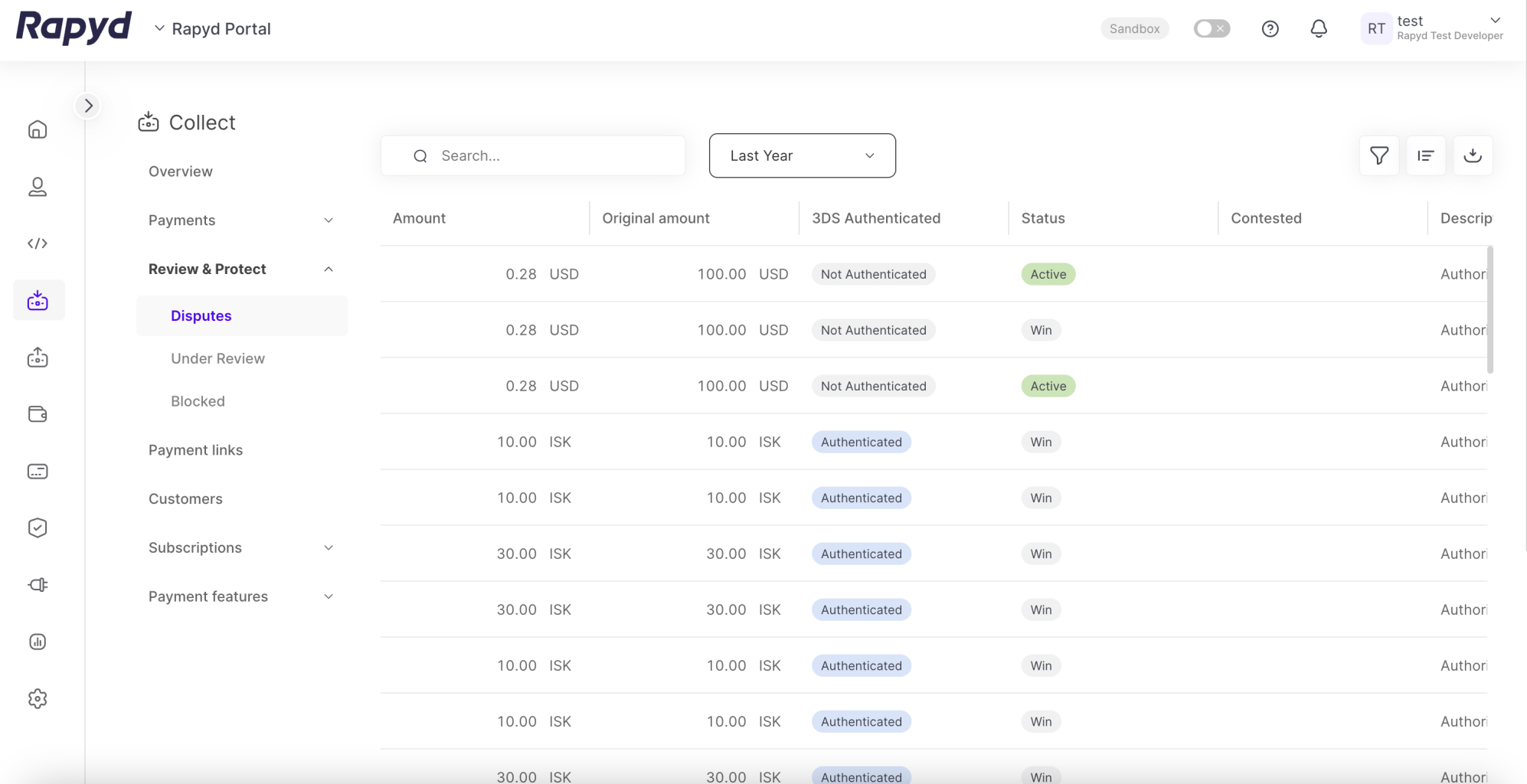

Sign in as described in Accessing the Client Portal and navigate to Collect > Review & Protect > Disputes.

The Disputes page appears.

Customize the Columns

To add or remove columns, click the Customize Columns icon at the top right. The icon has three vertical bars. On the Customize Columns panel, select the columns you want to appear on screen and click Apply.

To change the column order on the panel, grab the left of the column title and drag it to a new position.

To sort the list, hover over a column header. If the cursor turns into a pointing finger, tap the header. An arrow indicates the sort direction. To change the direction, tap the header again.

To view more rows or columns, scroll down or to the right over the disputes table.

Filter the Fields and Export

To filter the list, click the Search field at the top. Suggested filters appear. Select a filter and type a value, or type a free text string. Then click the magnifying glass icon.

To clear a filter, delete the text in the Search field and click the magnifying glass icon.

To apply an advanced filter, click the Filter icon at the top right. In the Filter window, select a field and a condition, and enter a value. To define an additional filter, click + Add Filter and fill in the field, condition, and value. Then click Apply.

To clear an advanced filter, close the filter description.

To clear all advanced filters, click Clear All.

Click the export icon to export the fields into a CSV file.

The following table describes the fields in the Payments page.

Field | Description |

|---|---|

Amount | The total amount (original amount + fee). |

Category | The type of dispute. One of the following:

|

Created At | Date and time the dispute was made. |

Reason description | Dispute reason description. |

Customer ID | ID of the |

Customer's name | The name of the customer. |

Dispute ID | ID of the dispute starting with dispute_. |

Due Date | Due date for dispute to be resolved. In unix time. |

eWallet ID | ID of the ewallet tied to the dispute. String starting with ewallet_. |

Original Amount | Original amount of the payment. |

Original Dispute Amount | Original amount of the dispute. |

Payment ID | The payment ID, a string starting with payment_. |

Status | Indicates the status of the payment. One of the following:

|

Updated At | Date and time of the most recent update. |

Merchant Reference ID | Identifier for the transaction. Defined by the merchant. |

Card's last 4 digits | The last 4 digits of the card number. |

The message sequence diagrams below describe how information is exchanged between Rapyd, the merchant, the merchant's customers, and the card issuer.

Dispute - Challenge Won

Dispute - Challenge Lost

Dispute - Accepted

The finite state diagram below summarizes the statuses for disputes.

Description of Statuses

Status | Description |

|---|---|

ACT | Active - a payment dispute has been sent by the card issuer. |

RVW | Review - a dispute has been challenged and/or is pending review. |

WIN | Win - a dispute has been successfully challenged. |

LOS | Lose - a payment dispute has been accepted, or a challenge has failed. |

Categories

Category | Rapyd Dispute Reason | Possible Reason for Dispute |

|---|---|---|

Cardholder Dispute | Cardholder Dispute | Generic cardholder dispute (MC). |

Cardholder Dispute | Credit not processed | The customer claims that the purchased product was returned or the transaction was otherwise canceled, but you have not yet provided a refund or credit. |

Cardholder Dispute | Goods or Services Not Provided | The customer claims they did not receive the products or services purchased. |

Cardholder Dispute | Product unacceptable | The product or service was received but was defective, damaged, or not as described. |

Cardholder Dispute | Subscription canceled | The customer claims that you continued to charge them after a subscription was canceled. |

Cardholder Dispute | Counterfeit Merchandise | The merchandise was identified as counterfeit by the owner of the intellectual property, a government agency, or a neutral third-party expert. |

Fraud | Fraud | The cardholder claims that they didn’t authorize the payment. This can happen if the card was lost or stolen and used to make a fraudulent purchase. It can also happen if the cardholder doesn’t recognize the payment as it appears on the billing statement from their card issuer. Note: This is the most common type of dispute. |

Processing Errors | Processing Errors |

|

Authorization | Authorization |

|

General | General | This is an uncategorized dispute, so you should contact the customer for additional details to find out why the payment was disputed. |