Two-Step Payment

Create and capture card payments using the Client Portal.

You can create a card payment and capture the funds in two steps using the Virtual Terminal.

For a Two-Step Payment, the card is first authorized and then the funds are captured after the order has been completed.

This procedure requires Owner or Administrator privileges.

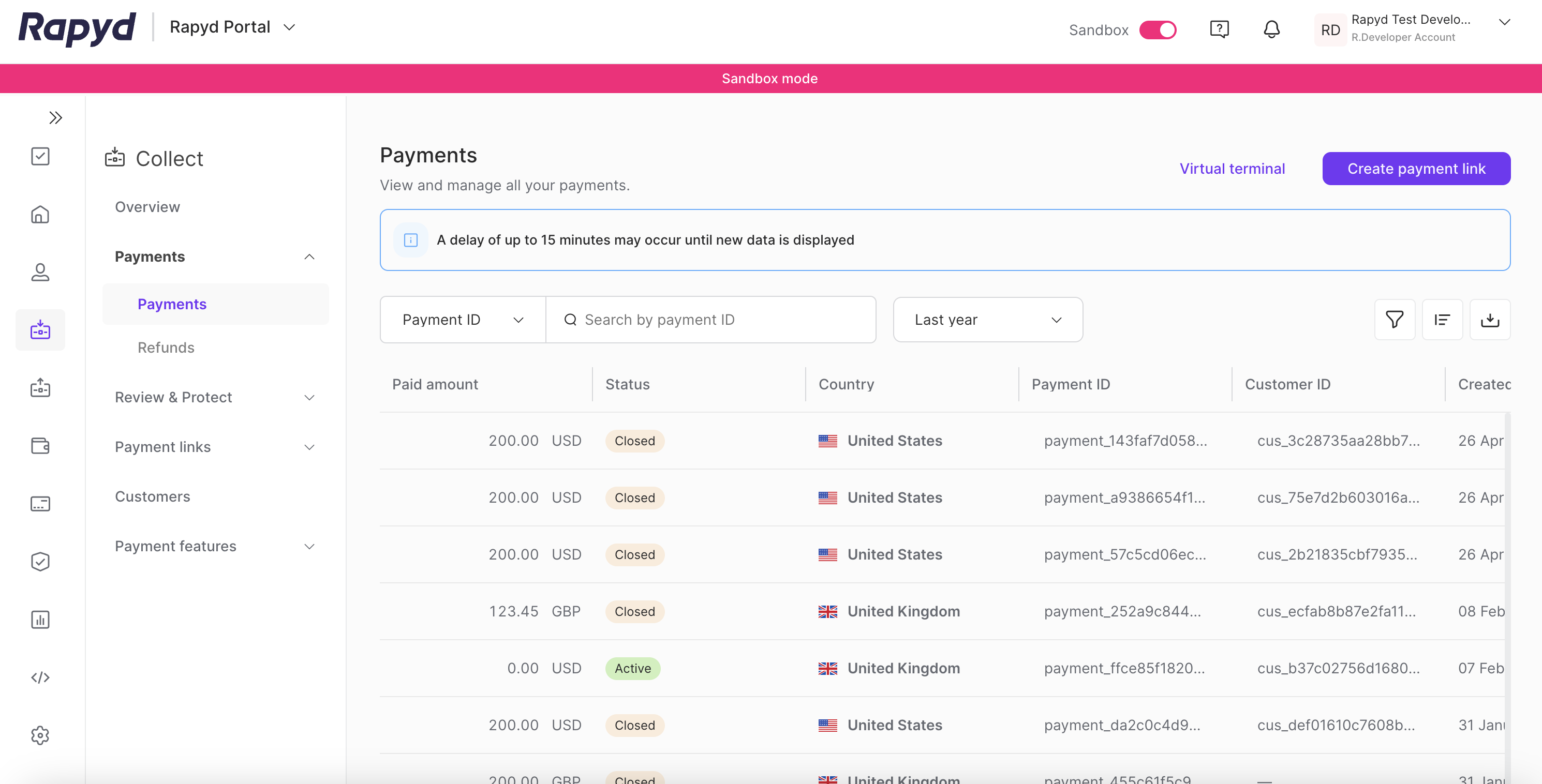

Sign in as described in Accessing the Client Portal and navigate to Collect > Payments.

The Payments page appears.

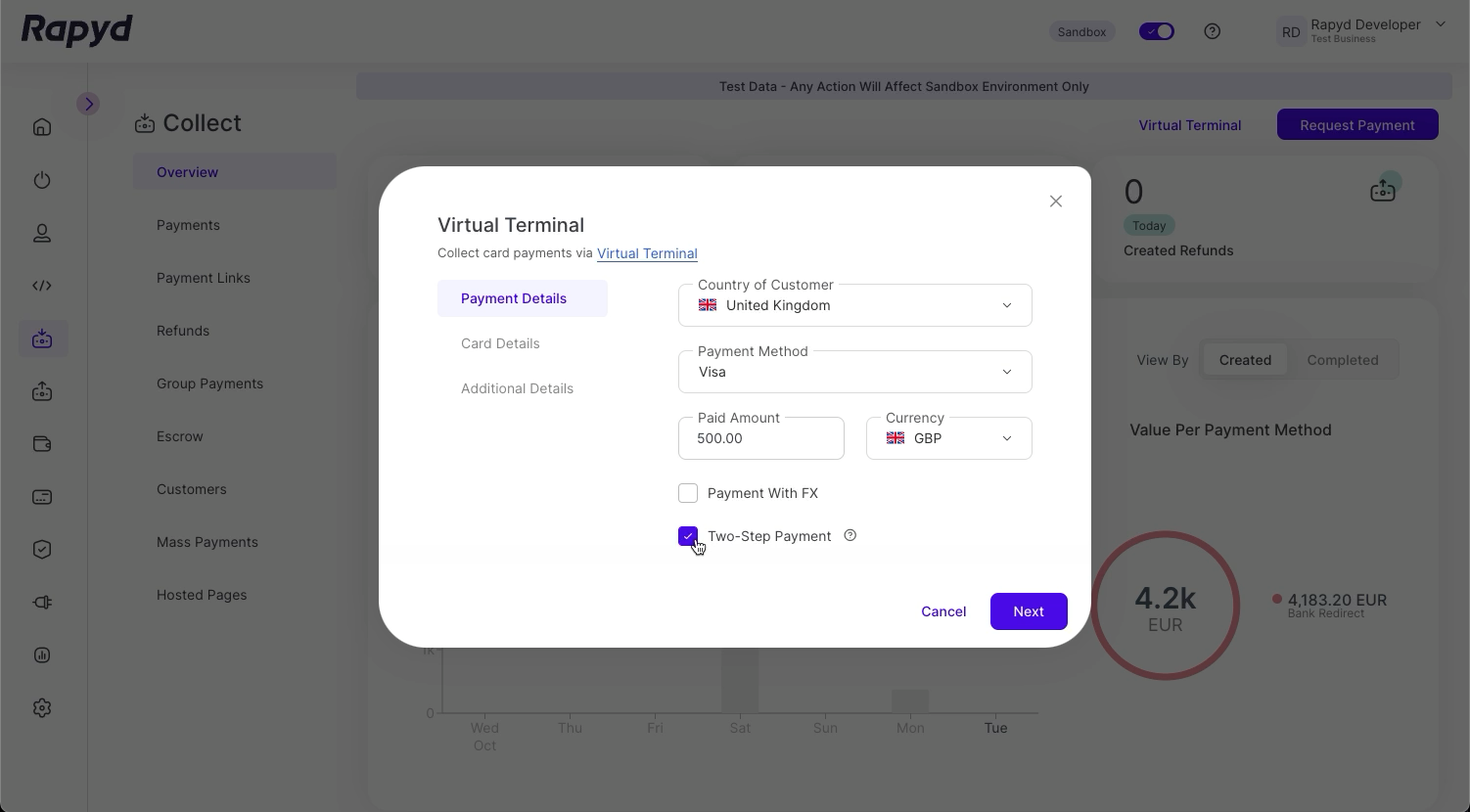

Select Virtual Terminal at the top right.

The Virtual Terminal Payment Details dialogue box appears.

Fill in the following required fields:

Country - The country of the payment.

Payment Method - The name of the payment method type. For example: us_debit_mastercard_card.

Amount - The amount of the payment.

Currency - The currency of the payment.

Required Fields - Might appear, depending on your payment method.

Select the Two-Step Payment option.

Tap Next.

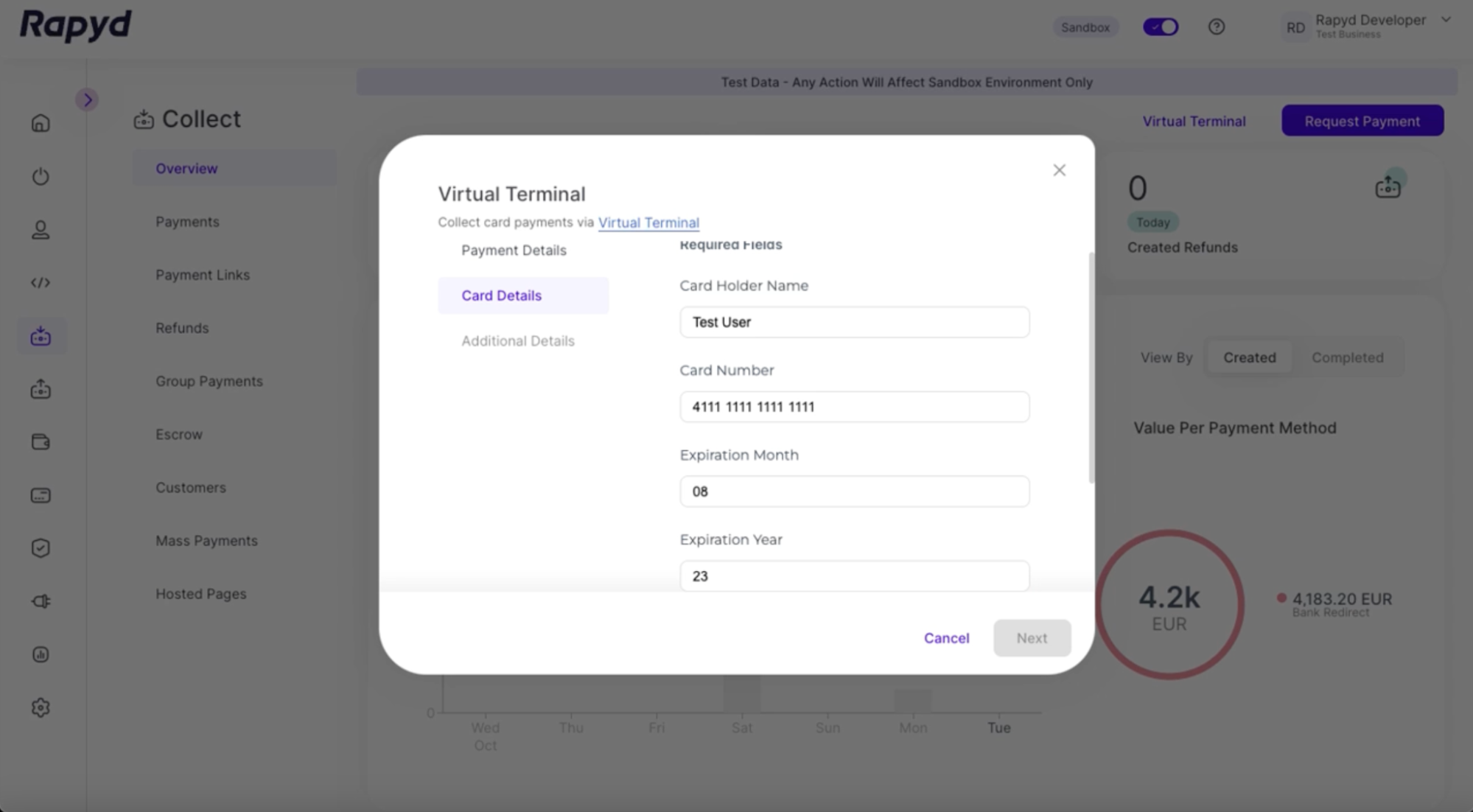

The Virtual Terminal Card Details dialogue box appears.

Fill in the following required fields:

Card Holder Name - The name of the customer that holds the card.

Card Number - The 16 digit number of the card.

Expiration Month - The month the card expires.

Expiration Year - The year the card expires.

CVV - The 3 digit Card Verification Value for the card.

Click Next.

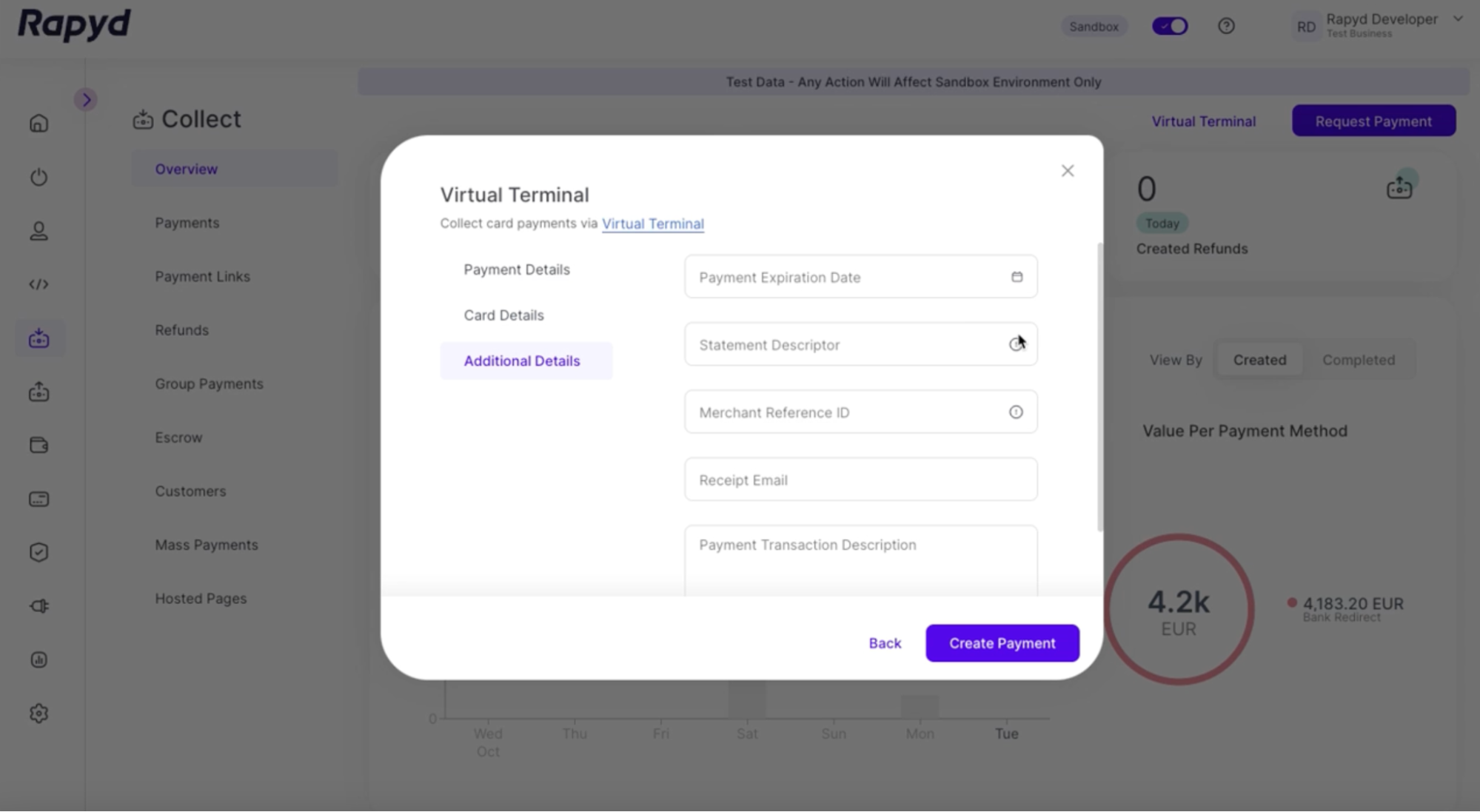

The Virtual Terminal Additional Details dialog box appears.

Click Create Payment.

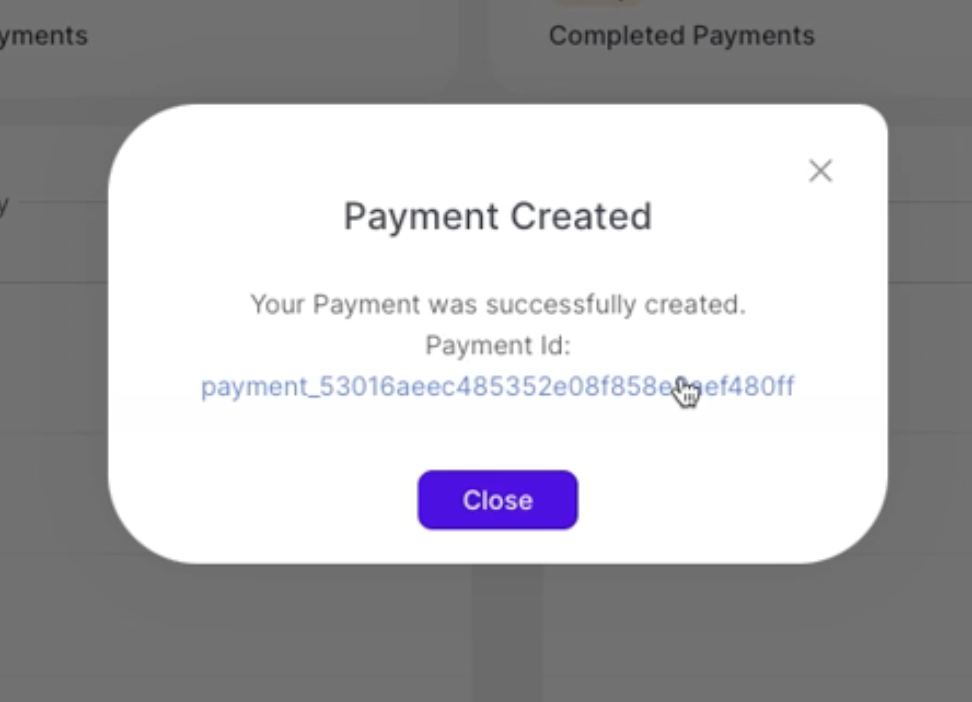

The Payment Created dialog box appears.

Click on the generated Payment ID after completing the steps in How to Collect a Card Payment .

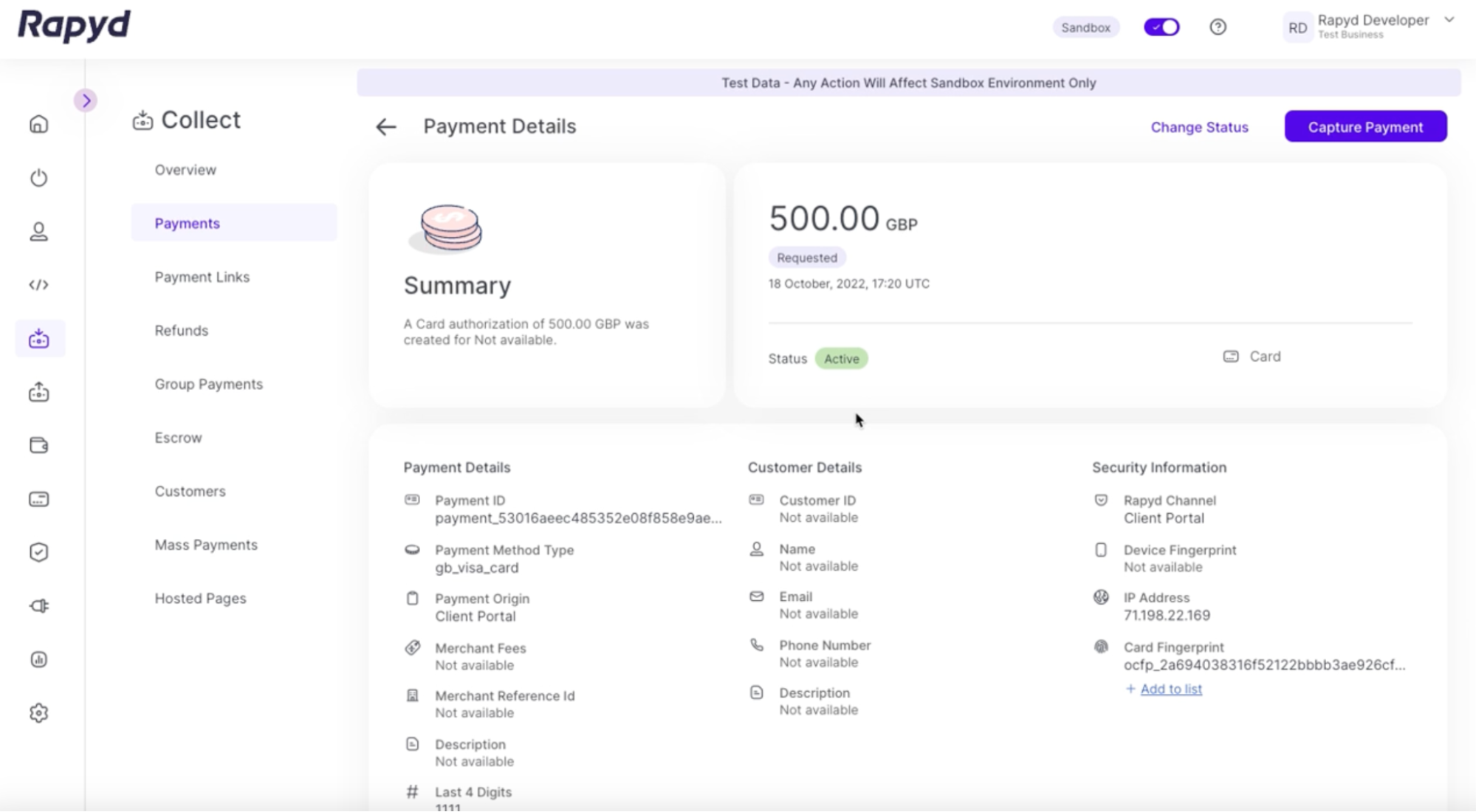

The Payment Details page for the payment appears.

Click Capture Payment in the upper right corner.

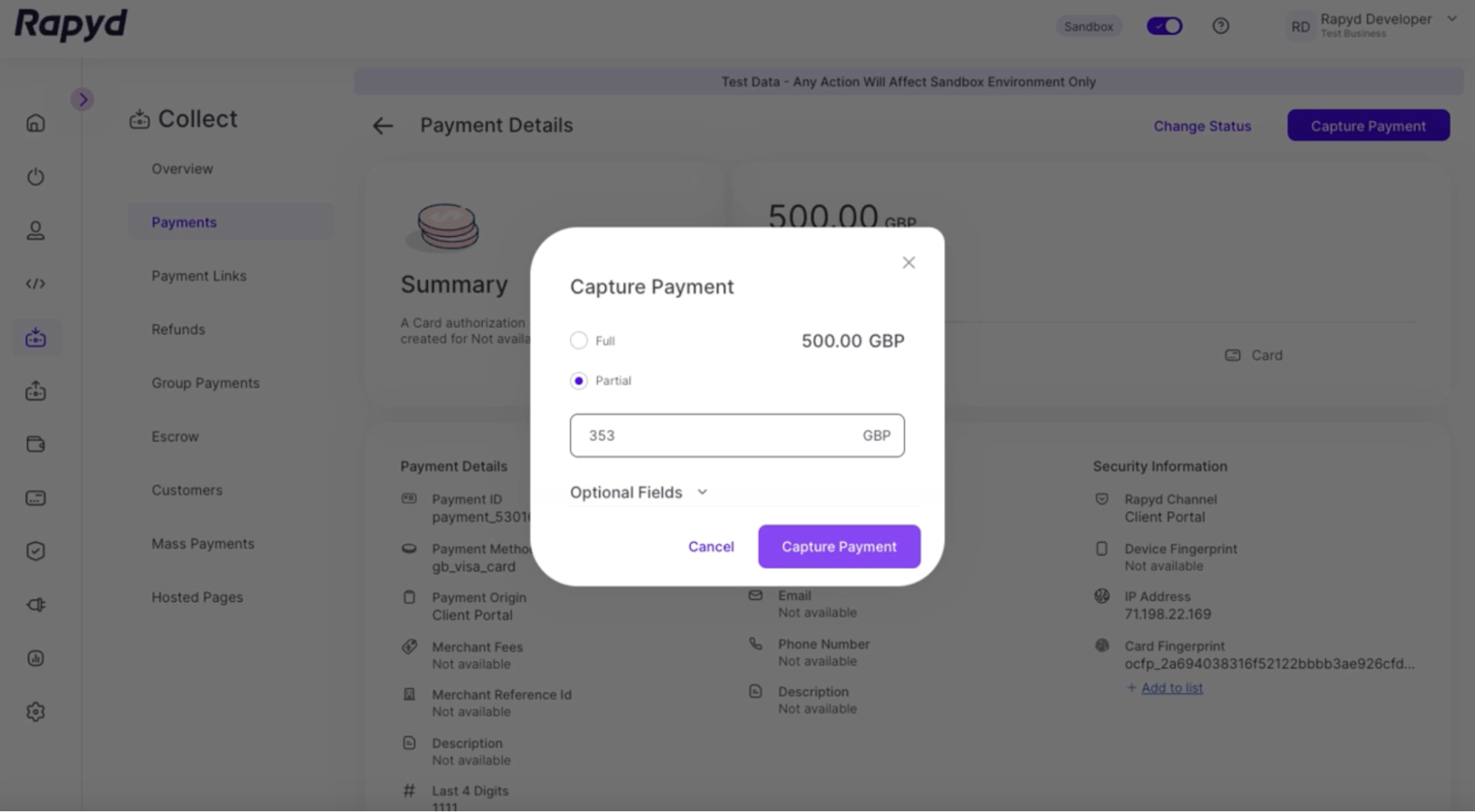

The Capture Payment dialog box appears.

You can capture:

Full amount

Partial amount

Select either the Full or Partial option.

Note: If the Partial option is selected, enter the partial amount in the dialog box field.

Click Capture Payment.

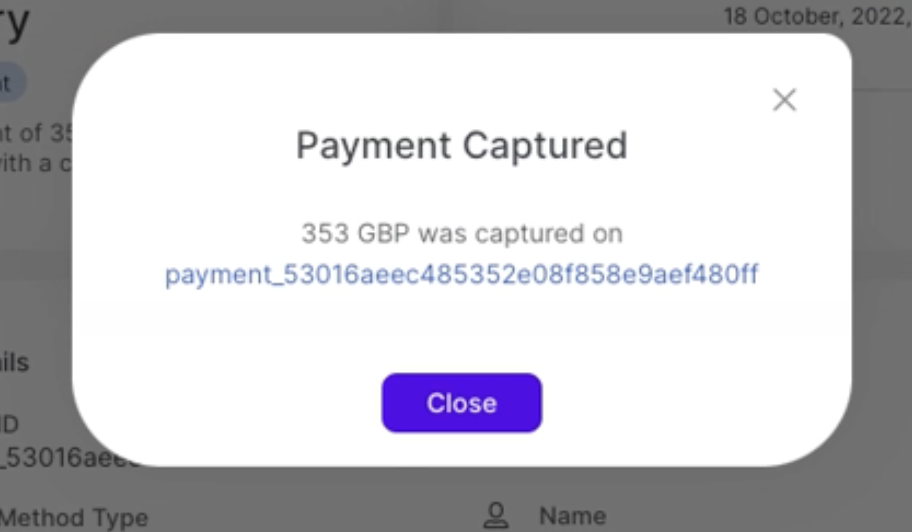

The Payment Captured dialog box appears.