Card on File With 3DS Verification

For improved security, 3D Secure requires customers to provide additional details when using card on file for online payments.

Some issuers in Europe and Asia require 3D Secure for card verification. For this reason, when a customer uses their card for the first time on your website and chooses to store their card information for future purchases, they are required to confirm the transaction using 3D Secure. Once the customer has verified their card and it has been successfully stored as a token, they will not need to verify their card again for future purchases.

Common benefits include:

Easier and quicker payment process results in better checkout experience for your customer.

Liabilities owing to any chargebacks are passed from the merchant to the issuer.

Reduces the risk of fraud and makes payments safer.

No extra costs for the additional step of 3DS verification which provides increased security for your transactions.

Finding the specific card payment methods you'll accept and the corresponding required fields that customers fill out is described under How it Works.

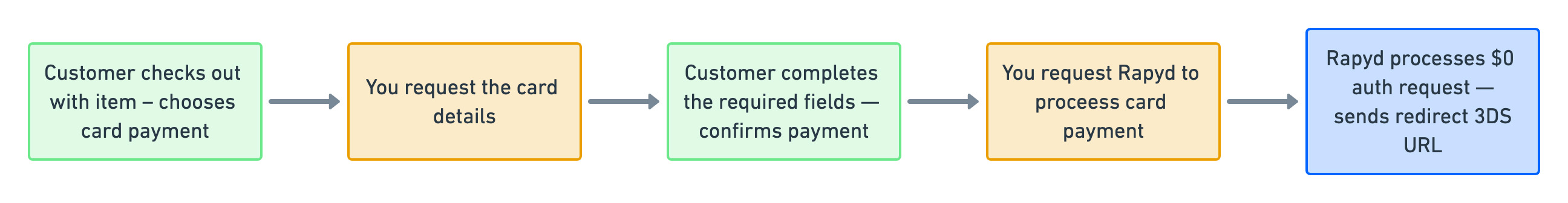

Step 1: Authorize the Card

Your customer checks out with an item, visits payment page with a list of payment methods, and chooses card.

Your website or app requests the card details from Rapyd and present to the customer.

The customer completes the required fields and then selects Register or Pay.

Your website sends the request to Rapyd to process the card payment.

Rapyd processes the $0 Auth request and sends a redirect URL to a 3DS processing site.

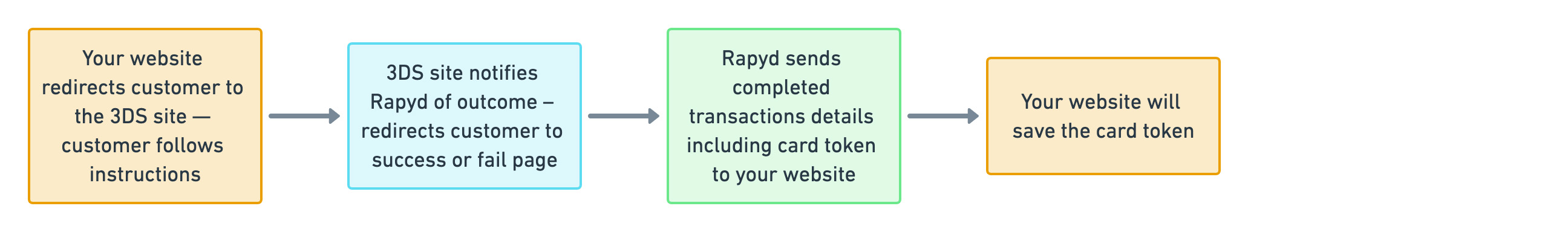

Step 2: Secure and Complete the $0 Auth Transaction

Your website redirects the customer to the 3DS processing site, and they follow instructions for authentication transaction.

The 3DS processing site notifies Rapyd of the transaction outcome and redirects the customer to your success or failure page.

Rapyd sends the completed transaction details including the card token to your website.

Your website will save the card token.

Check which payment methods are accepted in your customer's country.

Note: For illustration purposes, GB and GBP are used for country and currency in the sample codes.

3DS Card Layer

3DS layer is not available in all regions. It is automatically triggered when a regulatory mandate such as PSD2 requires it.

For more details on how to prevent fraudulent transactions, see Rapyd Protect.

To do that, use List Payment Methods by Country with the following parameters:

Description of Query Parameters

Query Parameter | Description |

|---|---|

country | Enter GB as the country code. |

currency | Enter GBP as the currency code. |

List Payment Methods by Country Request

Request for a list of all available GB payment methods.

Request

// Request URL: GET https://sandboxapi.rapyd.net/v1/payment_methods/country?country=GB¤cy=GBP // Message body absent

.NET Core

using System; namespace RapydApiRequestSample { class Program { static void Main(string[] args) { try { string country = "GB"; string currency = "GBP"; string result = RapydApiRequestSample.Utilities.MakeRequest("GET", $"/v1/payment_methods/country?country={country}¤cy={currency}"); Console.WriteLine(result); } catch (Exception e) { Console.WriteLine("Error completing request: " + e.Message); } } } }

JavaScript

const makeRequest = require('<path-to-your-utility-file>/utilities').makeRequest; async function main() { try { const result = await makeRequest('GET', '/v1/payment_methods/country?country=GB¤cy=GBP'); console.log(result); } catch (error) { console.error('Error completing request', error); } }

PHP

<?php $path = $_SERVER['DOCUMENT_ROOT']; $path .= "/<path-to-your-utility-file>/utilities.php"; include($path); try { $object = make_request('get', '/v1/payment_methods/country?country=GB¤cy=GBP'); var_dump($object); } catch (Exception $e) { echo "Error: $e"; } ?>

Python

from pprint import pprint from utilities import make_request country = 'GB' currency = 'GBP' results = make_request(method='get', path=f'/v1/payment_methods/country?country={country}¤cy={currency}') pprint(results)

List Payment Methods by Country Response

Payment Method Type Object describes the fields in the response.

Response

{ "status": { "error_code": "", "status": "SUCCESS", "message": "", "response_code": "", "operation_id": "cfa35a73-aa0b-4e7e-839c-4c3b6149edd7" }, "data": [{ "type": "gb_visa_card", "name": "Visa", "category": "card", "image": "https://iconslib.rapyd.net/checkout/gb_visa_card.png", "country": "gb", "payment_flow_type": "card", "currencies": [ "GBP" ], "status": 1, "is_cancelable": false, "payment_options": [{ "name": "customer", "type": "customer", "regex": "", "description": "make sure a customer was created with first_name, last_name and email", "is_required": true, "is_updatable": false } ], "is_expirable": true, "is_online": false, "minimum_expiration_seconds": 600, "maximum_expiration_seconds": 604800 } ] }

The data section of the response shows that a Visa card is an acceptable payment method.

List Payment Methods Response

A full API response lists many payment methods.

You need to find out which fields you have to fill for the payment method.

To do that, use the Get Payment Method Required Fields with the following parameter:

Description of Path Parameters

Path Parameter | Description |

|---|---|

type | Enter gb_visa_card as the payment method type. |

Get Payment Method Required Fields Request

You need to request for the set of required fields for a Visa card.

Request

// Request URL: GET https://sandboxapi.rapyd.net/v1/payment_methods/gb_visa_card/required_fields // Message body absent

NET.Core

using System; namespace RapydApiRequestSample { class Program { static void Main(string[] args) { try { string type = "gb_visa_card"; string result = RapydApiRequestSample.Utilities.MakeRequest("GET", $"/v1/payment_methods/{type}/required_fields"); Console.WriteLine(result); } catch (Exception e) { Console.WriteLine("Error completing request: " + e.Message); } } } }

JavaScript

const makeRequest = require('<path-to-your-utility-file>/utilities').makeRequest; async function main() { try { const result = await makeRequest('GET', '/v1/payment_methods/gb_visa_card/required_fields'); console.log(result); } catch (error) { console.error('Error completing request', error); } }

PHP

<?php $path = $_SERVER['DOCUMENT_ROOT']; $path .= "/<path-to-your-utility-file>/utilities.php"; include($path); try { $object = make_request('get', '/v1/payment_methods/gb_visa_card/required_fields'); var_dump($object); } catch (Exception $e) { echo "Error: $e"; } ?>

Python

from pprint import pprint from utilities import make_request payment_method = 'gb_visa_card' results = make_request(method='get', path=f'/v1/payment_methods/{payment_method}/required_fields') pprint(results)

Get Payment Method Required Fields Response

Payment Method Type Object describes the fields in the response.

Response

{ “status”: { “error_code”: “”, “status”: “SUCCESS”, “message”: “”, “response_code”: “”, “operation_id”: “3b7a2391-6612-478e-b79e-38d7f8d33ff9” }, “data”: { “type”: “gb_visa_card”, “fields”: [ { “name”: “name”, “type”: “string”, “regex”: “”, “is_required”: true, “instructions”: “card holder name” }, { “name”: “number”, “type”: “string”, “regex”: “”, “is_required”: true, “instructions”: “card number” }, { “name”: “expiration_month”, “type”: “string”, “regex”: “”, “is_required”: true, “instructions”: “expiration month as string, 01-12" }, { “name”: “expiration_year”, “type”: “string”, “regex”: “”, “is_required”: true, “instructions”: “expiration year in to digits as string, 18-99” }, { “name”: “cvv”, “type”: “string”, “regex”: “”, “is_required”: true, “instructions”: “card cvv” } ], “payment_method_options”: [ { “name”: “3d_required”, “type”: “string”, “regex”: “”, “description”: “”, “is_required”: false, “is_updatable”: false } ], “payment_options”: [ { “name”: “description”, “type”: “string”, “regex”: “”, “description”: “the description field must be filled in.“, “is_required”: true, “is_updatable”: false }, { “name”: “complete_payment_url”, “type”: “string”, “regex”: “”, “description”: “the complete_payment_url field must be filled in.“, “is_required”: true, “is_updatable”: false }, { “name”: “error_payment_url”, “type”: “string”, “regex”: “”, “description”: “the error_payment_url field must be filled in.“, “is_required”: true, “is_updatable”: false } ], “minimum_expiration_seconds”: 600, “maximum_expiration_seconds”: 604800 } }

The response shows that for a GB Visa card, you must provide:

namenumberexpiration_monthexpiration_yearcvv

Ensure that your customer completes these fields.

At this stage, your customer should have completed the following:

Selected Visa as the payment option.

Filled in the fields required for paying with the card.

Special Testing Behavior in Sandbox

To use the sandbox to simulate a payment that requires 3DS authentication, set the 'amount' to between 1000.00 and 1999.99.

When your customer confirms paying with the card, you have to make sure that Rapyd verifies the card by calling Create Payment with the following parameters:

Description of Body Parameters

Body Parameter | Description |

|---|---|

payment_method | Enter an object with the following fields:

|

amount | Enter 0.00 as the payment amount. |

currency | Enter GBP as the currency code. |

capture | Enter false as the value since amount is 0. This tells Rapyd to collect the payment for you as soon as possible. |

error_payment_url | Replace |

complete_payment_url | Replace |

Create Payment Request

You ask Rapyd to verify your customer's card.

Request

// Request URL: POST https://sandboxapi.rapyd.net/v1/payments // Message body: { "amount": 0.00, "currency": "GBP", "payment_method": { "type":"gb_visa_card", "fields": { "number": "4111111111111111", "expiration_month": "10", "expiration_year": "29", "cvv": "123", "name":"Cardholder Name" } }, "error_payment_url": "https://error.example.net", "complete_payment_url": "https://complete.example.net", "capture": false }

.NET.Core

using System; using System.Text.Json; namespace RapydApiRequestSample { class Program { static void Main(string[] args) { try { var requestObj = new { amount = 0.00, currency = "GBP", payment_method = new { type = "gb_visa_card", fields = new { number = "4111111111111111", expiration_month = "10", expiration_year = "29", cvv = "123", name ="Cardholder Name" } }, error_payment_url = "https:error.example.net", complete_payment_url = "https:complete.example.net", capture = false }; string request = JsonSerializer.Serialize(requestObj); string result = RapydApiRequestSample.Utilities.MakeRequest("POST", "/v1/payments", request); Console.WriteLine(result); } catch (Exception e) { Console.WriteLine("Error completing request: " + e.Message); } } } }

JavaScript

const makeRequest = require('<path-to-your-utility-file>/utilities').makeRequest; async function main() { try { const body = { amount: 0.00, currency: 'GBP', payment_method: { type: 'gb_visa_card', fields: { number: '4111111111111111', expiration_month: '10', expiration_year: '29', cvv: '123' name" 'Cardholder Name' } }, error_payment_url: 'https://error.example.net', complete_payment_url: 'https://complete.example.net', capture: false }; const result = await makeRequest('POST', '/v1/payments', body); console.log(result); } catch (error) { console.error('Error completing request', error); } }

PHP

<?php $path = $_SERVER['DOCUMENT_ROOT']; $path .= "/<path-to-your-utility-file>/utilities.php"; include($path); $body = [ 'amount' => 0.00, 'currency' => 'GBP', 'payment_method' => [ 'type' => 'gb_visa_card', 'fields' => [ 'number' => '4111111111111111', 'expiration_month' => '10', 'expiration_year' => '29' 'cvv' => '123', 'name' => 'Cardholder Name' ] ], 'error_payment_url' => urldecode('https://error_example.net'), 'complete_payment_url' => urldecode('https://complete_example.net') 'payment_method_options'=> [ '3d_required => ], 'capture' => false, '' ]; try { $object = make_request('post', '/v1/payments', $body); var_dump($object); } catch (Exception $e) { echo "Error: $e"; } ?>

Python

from pprint import pprint from utilities import make_request payment_body = { 'amount': 0.00, 'currency': 'GBP', 'payment_method': { 'type': 'gb_visa_card', 'fields': { 'number': '4111111111111111', 'expiration_month': '10', 'expiration_year': '29', 'cvv': '123', 'name': 'Cardholder Name' } }, 'error_payment_url': 'https://error_example.net', 'complete_payment_url': 'https://complete_example.net', 'payment_method_options': { '3d_required': true }, 'capture': false } results = make_request(method='post', path='/v1/payments', body=payment_body) pprint(results)

Create Payment Response

Let's take a look at the response. Payment Object describes the fields in the response.

Response

{ "status": { "error_code": "", "status": "SUCCESS", "message": "", "response_code": "", "operation_id": "5dd15363-e0a2-48b5-878e-30296b50a6b2" }, "data": { "id": "payment_b151373c6124a05dbf8614be3948e297", "amount": 0, "original_amount": 0.00, "is_partial": false, "currency_code": "GBP", "country_code": "gb", "status": "ACT", "description": "test2", "merchant_reference_id": "", "customer_token": "cus_57153838f4eb9052e87649a462aedd6e", "payment_method": "card_f372e6e5a780424104ac850cffeab03e", "expiration": 1600169279, "captured": false, "refunded": false, "refunded_amount": 0, "receipt_email": "", "redirect_url": "https://redirect.example.net/, "complete_payment_url": "http://www.rapyd.net", "error_payment_url": "http://www.rapyd.net/error.html", "receipt_number": "", "flow_type": "", "address": null, "statement_descriptor": "rapyd 3ds testing", "transaction_id": "", "created_at": 1599564479, "metadata": {}, "failure_code": "", "failure_message": "", "paid": false, "paid_at": 0, "dispute": null, "refunds": null, "order": null, "outcome": null, "visual_codes": {}, "textual_codes": {}, "instructions": {}, "ewallet_id": "ewallet_f7d6a6bfade1cabb06f3e264d8f1899b", "ewallets": [ { "ewallet_id": "ewallet_f7d6a6bfade1cabb06f3e264d8f1899b", "amount": 0.00, "percent": 100, "refunded_amount": 0 } ], "payment_method_options": { "3d_required": true }, "payment_method_type": "gb_visa_card", "payment_method_type_category": "card", "fx_rate": "", "merchant_requested_currency": null, "merchant_requested_amount": null, "fixed_side": "", "payment_fees": null, "invoice": "", "escrow": null, "group_payment": "", "initiation_type": "customer_present" } }

The data section of the response shows:

amountis 0.00currencyis GBPYour guest customer is automatically assigned a customer ID. The payment method is assigned a payment method ID. Both IDs are unique to this one transaction.

capturedis false - the card payment amount is 0.redirect_urlishttps://redirect.example.net, which is the URL where you redirect your guest customer to complete the payment process.paidis false andstatusis ACT (active), which indicates that we are still waiting for your guest customer to finish the 3DS process.

At this point, you have redirected the customer to https://redirect.example.net, which is a 3DS verification site. This site might handle the 3DS verification itself, or it might redirect the customer to the website of their own card.

The customer follows the authentication instructions on the screen, which could involve copying the number from an email or an SMS into the web page.

When the process is completed successfully, Rapyd sends you a webhook with details of the completed transaction.

Let's take a look at Webhook - Payment Completed.

Webhook

{ "id": "wh_7f18c2b90892652fe7ff2cb7d0537732", "type": "PAYMENT_COMPLETED", "data": { "id": "payment_b151373c6124a05dbf8614be3948e297", // ... "paid": true, // ... "amount": 0.00, "status": "CLO", // ... "currency_code": "GBP", // ... "customer_token": "cus_57153838f4eb9052e87649a462aedd6e", "payment_method": "card_f372e6e5a780424104ac850cffeab03e", // ... "payment_method_type_category": "card" }, "trigger_operation_id": "", "status": "NEW", "created_at": 1551173303 }

The data section of the webhook shows:

paidis true andstatusis CLO (closed), which indicates that the money has been paid.amountis 0.00currency_codeis GBPThe

customer_tokenandpayment_methodare the same as in the Create Payment response.

Request

JSON

https://sandboxapi.rapyd.net/v1/customers/cus_57153838f4eb9052e87649a462aedd6e { “default_payment_method”: "card_f372e6e5a780424104ac850cffeab03e" }

Response

Response

{ “status”: { “error_code”: “”, “status”: “SUCCESS”, “message”: “”, “response_code”: “”, “operation_id”: “e3fb342e-9562-42ed-9bf6-056a2609270c” }, “data”: { “id”: “cus_57153838f4eb9052e87649a462aedd6e”, “delinquent”: false, “discount”: null, “name”: “payment_2e7e75edbde869e04aa12155c0be13be”, “default_payment_method”: “card_f372e6e5a780424104ac850cffeab03e”, “description”: “”, “email”: “”, “phone_number”: “”, “invoice_prefix”: “”, “addresses”: [], “payment_methods”: { “data”: [ { “id”: “card_f372e6e5a780424104ac850cffeab03e”, “type”: “gb_credit_visa_card”, “category”: “card”, “metadata”: null, “image”: “https://iconslib.rapyd.net/checkout/sg_credit_visa_card.png”, “name”: “testing”, “last4”: “4977", “cvv_check”: “unchecked”, “bin_details”: { “brand”: null }, “expiration_year”: “24", “expiration_month”: “12", “fingerprint_token”: “” } ], “has_more”: false, “total_count”: 1, “url”: “/v1/customers/cus_abb5c09d9c5bf8c0c8cb00b14ec5c892/payment_methods” }, “subscriptions”: null, “created_at”: 1594894949, “metadata”: {}, “business_vat_id”: “”, “ewallet”: “” } }

When your customer pays with their stored card, you submit the payment to Rapyd for processing.

To submit the customer's payment, use Create Payment with the following parameters:

Description of Body Parameters

Body Parameter | Description |

|---|---|

amount | Enter 9.99 as the payment amount. |

currency | Enter GBP as the currency code. |

customer | Enter the 'customer_id' that you received on the Create Payment Response (for example, "customer_token": "cus_57153838f4eb9052e87649a462aedd6e") |

Create Payment Request

Request Rapyd to process your customer's payment for 9.99 GBP (Pound Sterling) (as shown in this example code below).

Request

// Request URL: POST https://sandboxapi.rapyd.net/v1/payments // Message body: { "amount": 9.99, "currency": "GBP", "customer": "cus_8ded332b08966abf51bdc28c106acb7c" }

Create Payment Response

Create Payment describes the fields in the response.

Response

{ "status": { "error_code": "", "status": "SUCCESS", "message": "", "response_code": "", "operation_id": "4e44e8c1-ee8c-411a-a2de-a2a2ae0122d3" }, "data": { "id": "payment_7b4cb9456f1ff73132831fc2e35d88be", "amount": 9.99, "original_amount": 9.99, "is_partial": false, "currency_code": "GBP", "country_code": "GB", "status": "CLO", // ... "customer_token": "cus_57153838f4eb9052e87649a462aedd6e", "payment_method": "card_f372e6e5a780424104ac850cffeab03e", "expiration": 0, "captured": true, // ... "created_at": 1581248060, // ... "paid": true, "paid_at": 1581248060, // ... "payment_method_type": "gb_visa_card", "payment_method_type_category": "card", // ... } }

The response (in the sample code above) shows that Rapyd successfully processed the payment based on the amount, currency, and Customer ID. A sum of 9.99 GBP was paid from the customer's card.

You'll always get a similar response. The only difference will be the date and payment ID, and the amount if it's not identical.

You can see that the payment was successful since the status (under data) is CLO (closed). Create Payment lists possible values for status.

At this point, you can inform the customer that the purchase is complete.

Account Name Inquiry

Add the full_name object to the request to perform an Account Name Inquiry (ANI). The fields for the object include: first_name, middle_name, and last_name. The card scheme matches the cardholder details with the cardholder’s bank information. The ANI is used for fraud management. See Create Payment or Add Payment Method to Customer for additional details.

Create Payment Request

Request

// Request URL: POST https://sandboxapi.rapyd.net/v1/payments // Message body: { "amount": 0, "currency": "GBP", "capture": false, "save_payment_method": true, "customer": { "name": "John", "email": "johndoe@rapyd.net" }, "payment_method": { "type": "gb_visa_card", "full_name": { "first_name": "John", "middle_name": "Johnson", "last_name": "Doe" }, "fields": { "number": "4111111111111111", "expiration_month": "02", "expiration_year": "27", "name": "John Doe", "cvv": "345" } } }

Create Payment Response

Response

{ "status": { "error_code": "", "status": "SUCCESS", "message": "", "response_code": "", "operation_id": "f3097094-df3f-4f19-a19c-d07156ec40de" }, "data": { "id": "payment_5a32b5989155ba3b75454edba4f52401", "amount": 0, "original_amount": 0, "is_partial": false, "currency_code": "GBP", "country_code": "GB", "status": "ACT", "description": "", "merchant_reference_id": "", "customer_token": "cus_c14579755a7f069a7a8ffa7245aa17cf", "payment_method": null, "payment_method_data": { "id": null, "type": "gb_visa_card", "category": "card", "metadata": null, "image": "", "webhook_url": "", "supporting_documentation": "", "next_action": "3d_verification", "full_name": { "first_name": "John", "middle_name": "Johnson", "last_name": "Doe" }, "account_name_inquiry": { "account_name_inquiry_result": "not_performed", "account_name_inquiry_details": { "last_name": null, "first_name": null, "middle_name": null } }, "name": "John Doe", "last4": "1111", "acs_check": "unchecked", "cvv_check": "unchecked", "bin_details": { "type": "DEBIT", "brand": "VISA", "level": "CLASSIC", "issuer": "CONOTOXIA SP. Z O.O", "country": "PL", "bin_number": "411111" }, "expiration_year": "27", "expiration_month": "02", "fingerprint_token": "ocfp_e599f990674473ce6283b245e9ad2467", "payment_account_reference": "V00173Z6DA132UM78105DND4YLZMU", "network_reference_id": "828761" }, "auth_code": null, "expiration": 1761572794, "captured": false, "refunded": false, "refunded_amount": 0, "receipt_email": "", "redirect_url": "https://sandboxcheckout.rapyd.net/3ds-payment?token=payment_5a32b5989155ba3b75454edba4f52401", "complete_payment_url": "", "error_payment_url": "", "receipt_number": "", "flow_type": "", "address": null, "statement_descriptor": "Doc Team", "transaction_id": "", "created_at": 1760967994, "metadata": {}, "failure_code": "", "failure_message": "", "paid": false, "paid_at": 0, "dispute": null, "refunds": null, "order": null, "outcome": null, "visual_codes": {}, "textual_codes": {}, "instructions": [], "ewallet_id": null, "ewallets": [], "payment_method_options": {}, "payment_method_type": "gb_visa_card", "payment_method_type_category": "card", "fx_rate": 1, "merchant_requested_currency": null, "merchant_requested_amount": null, "fixed_side": "", "payment_fees": null, "invoice": "", "escrow": null, "group_payment": "", "cancel_reason": null, "initiation_type": "customer_present", "mid": "", "next_action": "3d_verification", "error_code": "", "remitter_information": {}, "save_payment_method": true, "merchant_advice_code": null, "merchant_advice_message": null, "authentication_result": { "eci": null, "result": "R", "version": "2.2.0", "cardholder_info": null }, "transaction_link_id": null } }